About the UNA

The University Neighbourhoods Association (UNA) acts as a municipal council for the residential areas on campus, promoting a vibrant, sociable, safe and diverse community at the University of British Columbia (UBC).

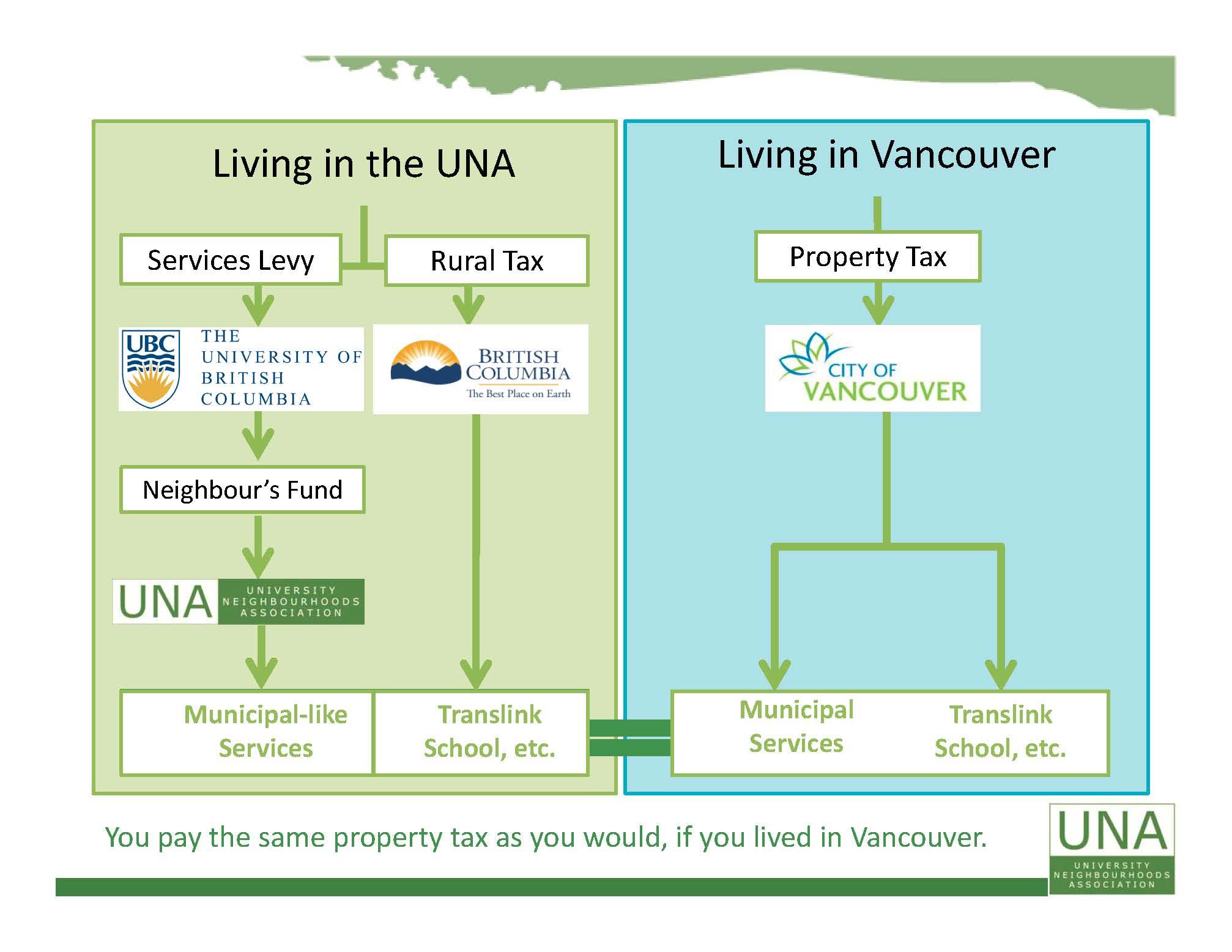

When you own or lease a property in BC, property taxes must be paid yearly. The money raised from the property taxes you pay is used to fund local programs and services. Homeowners in the UNA pay a Rural Tax to the BC Government and a Services Levy to UBC.

What is the UBC Services Levy?

The UBC Services Levy is a charge collected annually from homeowners at UBC to fund local programs and municipal-like services. The Services Levy is like the municipal portion of property taxes. It is called a levy rather than a tax because UBC is on unincorporated land and is not a municipality.

What is the UBC Services Levy used for?

Services Levy funds are collected by UBC and deposited into the Neighbours’ Fund which funds the University Neighbourhoods Association. The Neighbours’ Fund goes towards the UNA Operating Budget and Reserves.

The Operating Budget is used by the UNA to provide municipal-like services to UNA residents. The annual budget is developed by the UNA Board of Directors and approved after public consultation. Money the UNA generates is also put towards the Operating Budget.

The Neighbours’ Fund Reserves are held to meet the future needs of the community. Reserves are best practice and are required planning for the replacement of infrastructure and to guard against surprise costs.

How is my Services levy Calculated?

The Services Levy Rate equals the difference between the BC Rural Tax Rate and the City of Vancouver Residential Tax Rate. Your invoiced Services Levy amount is based on the value of your property, as determined by BC Assessment. For more information on the assessed value of your property, you can contact the BC Assessment Authority at 604-739-8588 or visit www.bcassessment.ca

When will I receive UBC Services Levy Notice?

UBC Services Levy notices are mailed out by UBC in mid-June annually. You can also access your account balance online or get more information by visiting https://finance.ubc.ca/tax-services-levy/services-levy

What is the Rural Property Tax?

If your property is not located in a city, town, district or village, it is in a rural area. UBC is unincorporated land so it is considered rural.

The BC government collects taxes on properties in rural areas to fund provincial services. The BC government also collects taxes on behalf of other organizations, such as Translink and the Greater Vancouver Regional District.

Rural tax is paid directly to the BC Government.

When will I receive Rural Property Tax if live in UBC?

Rural Property Tax notices are mailed out by the BC Government in early-June annually. You can also access your account balance online or get more information by visiting www.gov.bc.ca/ruralpropertytax

How do my taxes and services levy charges compared to residents in Vancouver?

UBC is required to ensure that the total property taxes paid by UNA homeowners is the same as the property taxes of a comparable property in the City of Vancouver. While homeowners in the UNA pay a Rural Tax to the BC government and the Services Levy to UBC, the two added together are the SAME as the City of Vancouver municipal tax for a property with the same assessed value.

I still have questions, who can I contact?

For questions on the UBC Services Levy:

UBC Department of Financial Services

T: 604-822-3596

E: levy@finance.ubc.ca

www.finance.ubc.ca/revenue/services-levy

For questions on the BC Rural tax:

Surveyor of Taxes Office

T: 604-660-2421

E: ruraltax@gov.bc.ca

www.gov.bc.ca/ruralpropertytax